Is A $1,000 Emergency Fund Enough?

Are you wondering if a $1,000 emergency fund is enough when you’re first trying to get out of debt? Let me explain part of our debt free journey in hopes to encourage you in yours.

If you follow Dave Ramsey, then you know his 7 baby step plan for financial freedom. The first step is to save up $1,000 for your emergency fund, so if you have an unexpected expense, then you have money set aside to pay for it. That way pulling out a credit card isn’t your first response anymore. Many people question his method and ask, “Is a $1,000 emergency fund enough for baby step one?”

The answer is no! No, $1,000 is not enough for a savings account. However, for the baby step plan, $1,000 is the right amount for baby step one. The purpose is to give you a little cushion, but the point is to feel uncomfortable. Why would you want to feel uncomfortable? Because the point is to work as hard as you can to get out of consumer debt, which is baby step 2.

If I Have A Large Family, Shouldn’t Baby Step One Be More?

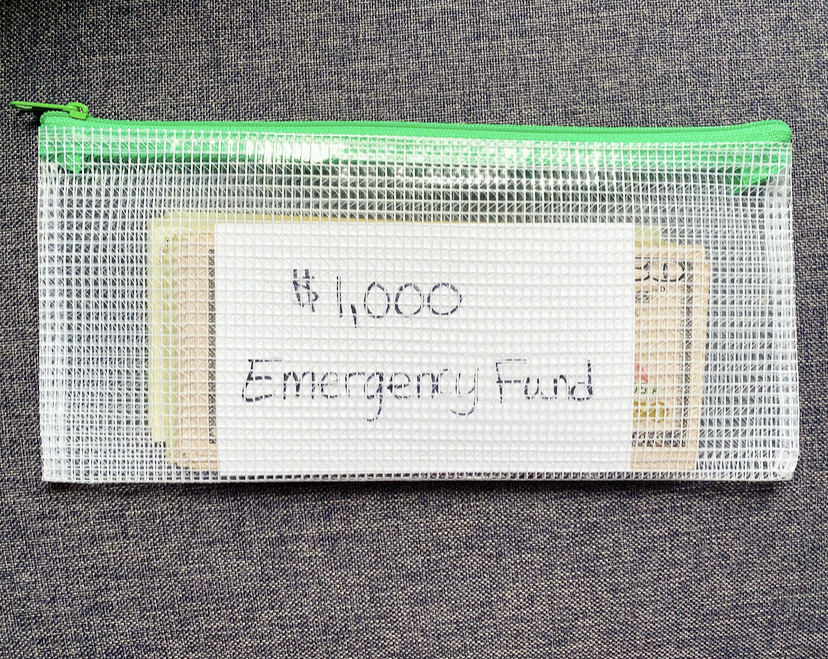

This is something I believed for a long time. When my husband I first started the baby step plan, we decided $4,000 was a much better savings number for us, since we had 4 children. This is where we felt the most comfortable. But there was a problem… we didn’t have the strong determination we needed to fight our way out of debt. We slowly chipped away at our debt without having any tenacity. It was hard to be persistent! We slowly kept going, but continued to find ways to spend money on frivolous things.

That $4,000 was no longer a needed cushion for us, it was a barrier that kept us from our goals. I had a sick and tired moment of how we were doing. Had we pushed hard in the beginning, we could have been out of debt by now.

I wanted to get out of baby step 2, I went to my husband and asked him to join me in being more determined, and he was feeling the same way. I was primarily handling the budget, so we started working together more. At this point, we had a little more than $26,000 left to pay off. I brought up the question, “Should we put $3,000 towards debt and just have a $1000 emergency fund?” My husband was on board and we did it! Plus, that $3,000 would pay off our credit card!

Now we only had $1,000 in savings and we were gazelle intense! Every bit of extra money went towards debt and we felt like nothing could take us down. We prayed our way through baby step 2. We asked God to protect our finances and our health as we fought our way through this debt.

What Does God Think Of Debt?

If you are a Christian, then let me talk to you about what God thinks of debt. Simply put, He does not approve. If you want to buy an expensive house, and your mortgage is going to suck a huge chunk of your monthly pay (aka: house poor), He is not on board!!!! I give this example because my husband and I almost made that mistake! We would have paid more than $900 in our mortgage payment, than what we pay now, which is much higher than 25% of our take home pay. There is no telling what kind of trouble financially we would have been in. Thank God for shutting the door, and not allowing it to happen.

I bring this topic up because it’s so motivating!!! When I learned how much God cared about my finances, it help push me to do my best.

The rich rules over the poor, and the borrower is the slave of the lender.

Proverbs 22: 7

Pay to all what is owed to them: taxes to whom taxes are owed, revenue to whom revenue is owed, respect to whom respect is owed, honor to whom honor is owed. Owe no one anything, except to love each other, for the one who loves another has fulfilled the law.

Romans 13: 7-8

To think of myself with chains around my ankles because I was a slave to the lender got under my skin, especially because it’s not necessary. I felt those chains too! Every month I was giving my money to a company that didn’t care about me, they just wanted my money and they were charging me interest! I couldn’t stand it any longer. It was time to change! It was time to move quicker, and now I felt motivated!

What If A Large Expense Occurs?

This is the scary part of having a $1,000 emergency fund. What if a large expense happens like a medical expense, car trouble, house maintenance issues? There is no doubt Murphy will come knocking on your door. Something will happen. Now it’s time to decide what is an emergency, and what isn’t.

If your air conditioning unit goes out and a repair man comes out to tell you that you must have a new unit, then get a second opinion. Ask if there’s any way to repair the situation until you can afford a new unit. This is just an example, but often times we go into crisis mode for no reason. Simply take a deep breath and look at your options. There is always more than one option!

Stop putting yourself in a trap. You are not a victim. Car trouble is going to happen, always! Start planning for it. Create a sinking fund for car maintenance. A sinking fund is setting aside small amounts of money each month for a specific purpose. If tires cost $600, then plan to put a little money each month aside for that. It will affect your debt pay off, but at least you have peace of mind because you are prepared.

I also have a Christmas sinking fund. Christmas is not an emergency, so I set aside $100 per month in a fund just for that. There are many expenses we would consider a need, but in reality they’re not. We need to look at the total picture and decide what we value for the future.

Lastly, remember that medical bills generally come with no interest and a payment plan can be made. Always ask questions, get second opinions, and ask yourself if it’s really an emergency or if it can wait. Talking to wise people who are good with money, and praying for God to give you direction will help guide you through the situation.

What If I Lose My Job?

If there is a major life crisis and you lose your income, then stop paying off debt. This is when you go into conserve mode.

You establish your 4 WALLS first:

- Shelter

- Food

- Utilities

- Transportation

It’s important to keep your persistent attitude. While you are working on finding a well paying job, deliver pizzas or work at Target, if you don’t get any unemployment help.

In a difficult season of our marriage, my husband lost his job unexpectedly and delivered pizzas for a while. We focused on our 4 WALLS, stopped all other payments and piled up cash. It was stressful, but it can be done! We are thankful for the experience now because it pushed my husband into an amazing career that he absolutely loves!

Paying Off Debt Is Temporary

Your gazelle intensity is essential for getting out of debt fast, especially with that $1,000 emergency fund. Once you are consumer debt free, you will move on to building a big emergency fund. It’s a great feeling to be on this side now with a growing emergency fund. We no longer owe lenders money (besides our mortgage). We are consumer debt free and it’s a great place to be! You can be there too! Be persistent, work hard, and follow the baby step plan. No more excuses.

To help us have a visual reminder, we created a debt chain. This was in our living room and we looked at it everyday. The kids helped us write motivating Bible verses and quotes. Having the kids involved helps with our motivation!

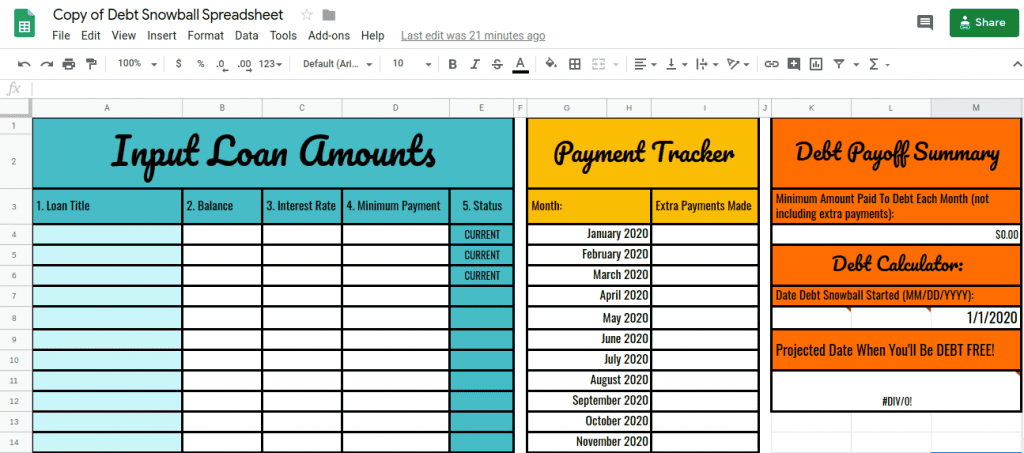

FREE Debt Pay Off Spreadsheet

Get your FREE DEBT SNOWBALL SPREADSHEET by clicking the link HERE. Download this template to your own drive.

Still Need Motivation? Watch This:

If You Liked This Article, You Might Also Like:

- Budgeting 101: Setting Up A Cash System Budget

- Best Grocery Budget For Your Family

- How To Budget Groceries and Household Items

*** This article is my personal response to a question that I get asked often on my social media accounts. This is my opinion based off of our personal experiences.

Pin For Later!